Understanding Business Valuation Approaches: Which Methods Apply to Your Business?

In today’s complex business landscape, knowing your company’s true value isn’t just about having a number; it’s about gaining actionable insights that drive critical decisions. Whether you’re preparing for a merger, acquisition, partnership dissolution, tax event, or simply want to understand your company’s worth, a professional business valuation provides crucial clarity about your organization’s financial health and market position.

At Sun Business Valuations, we take a different approach than the typical “one-size-fits-all” valuation firms. We understand that each business has unique characteristics, challenges, and goals. That’s why we customize our business valuation services to match your specific situation, ensuring you receive not just accurate figures but meaningful insights that support your business objectives.

The Three Fundamental Business Valuation Approaches

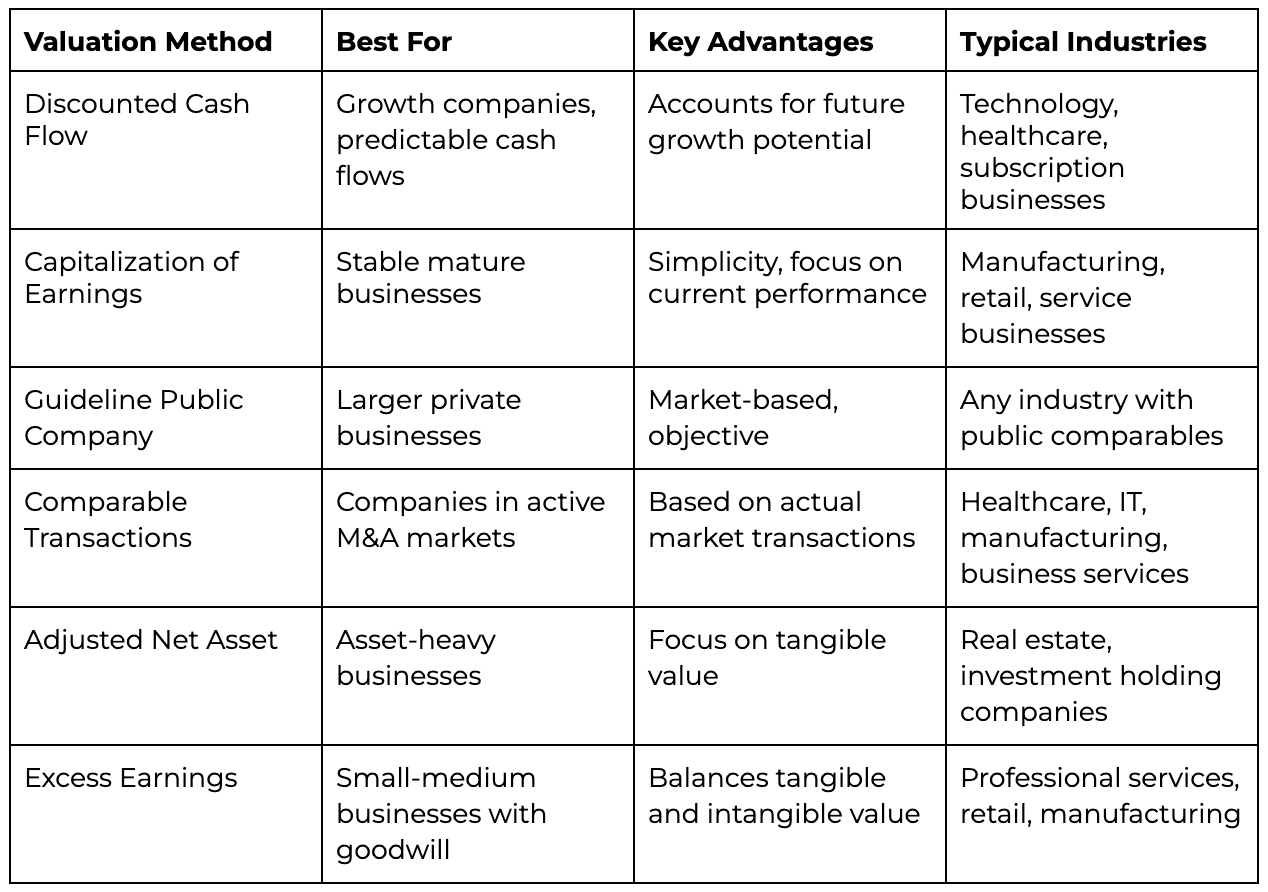

Different situations call for different valuation methodologies. Our professional business appraisal services utilize various approaches, each with distinct applications and benefits:

-

Income Approaches

Income-based business valuation methods determine a company’s value based on its ability to generate future economic benefits for its owners. These approaches are particularly relevant for established businesses with predictable cash flows.

Discounted Cash Flow (DCF) Method

The DCF method calculates the present value of projected future cash flows, adjusted for the time value of money and risk.

Best suited for: Companies with predictable future cash flows, growth-stage businesses, and those with significant upcoming changes in performance.

Industry Example: A technology SaaS company sought valuation for an investment round. Despite modest historical performance, the company demonstrated strong growth potential with recurring revenue streams. Using the DCF method, we projected increasing cash flows over five years, applying a discount rate that reflected the company’s risk profile. This approach properly accounted for the company’s growth trajectory, resulting in a valuation that secured the necessary funding while remaining defensible to investors.

Capitalization of Earnings Method

This method converts a single economic benefit, typically a normalized level of earnings, into value using a capitalization rate that reflects risk and expected growth.

Best suited for: Mature businesses with stable earnings and modest, consistent growth rates.

Industry Example: For a well-established manufacturing company with consistent historical performance, we applied the Capitalization of Earnings method. After normalizing earnings to account for non-recurring expenses and owner perquisites, we determined an appropriate capitalization rate based on industry risk factors and market conditions. This approach provided a streamlined yet accurate valuation that aligned with the company’s stable business model.

-

Market Approaches

Market-based business appraisal methods determine a company’s value by comparing it to similar businesses that have been recently sold or are publicly traded.

Guideline Public Company Method

This approach analyzes the market value of publicly traded companies in the same or similar industries and applies relevant multiples to the subject company’s financial metrics.

Best suited for: Mid-size to larger private companies that share characteristics with public companies.

Industry Example: When valuing a private healthcare services provider, we identified publicly traded companies with similar business models, growth rates, and risk profiles. After adjusting for size differences and liquidity factors, we applied appropriate multiples (EV/EBITDA, P/E) to the subject company’s financial metrics. This market-based perspective provided valuable context for the final valuation conclusion.

Comparable Transactions Method

This method examines recent sales of similar private companies to derive valuation multiples that can be applied to the subject company.

Best suited for: Companies in industries with frequent M&A activity and available transaction data.

Industry Example: A regional retail chain seeking an exit strategy engaged us for a business valuation service. By researching recent transactions involving similar retailers, we identified relevant valuation multiples based on revenue, EBITDA, and number of locations. These market-derived indicators provided compelling evidence of the company’s value in the current acquisition market, helping the owners set realistic expectations for their exit.

-

Asset Approaches

Asset-based valuation methods determine a company’s value by analyzing its underlying assets and liabilities, either individually or collectively.

Adjusted Net Asset Method

This approach adjusts a company’s balance sheet items to their fair market values and calculates the net value after accounting for all assets and liabilities.

Best suited for: Companies with significant tangible assets, holding companies, investment companies, or businesses that are not generating adequate returns.

Industry Example: A real estate holding company with multiple commercial properties needed a valuation for estate planning purposes. Using the Adjusted Net Asset Method, we revalued each property based on current market conditions, adjusted liabilities to reflect actual obligations, and accounted for potential tax implications. This asset-focused approach properly captured the underlying value of the company’s property portfolio.

Excess Earnings Method

This hybrid method combines elements of both asset and income approaches by valuing tangible assets separately from intangible assets or goodwill.

Best suited for: Small to medium-sized businesses with both significant tangible assets and goodwill value.

Industry Example: For a professional services firm with substantial equipment assets and established client relationships, we applied the Excess Earnings Method. We first determined the fair market value of tangible assets, then calculated “excess earnings” attributable to intangible assets. This approach provided a comprehensive valuation that accounted for both the firm’s physical resources and its valuable client relationships.

Selecting the Right Business Valuation Approach

Choosing the appropriate valuation method depends on several factors:

- Purpose of the valuation (tax planning, litigation, sale, etc.)

- Company characteristics (industry, size, growth stage)

- Available data (financial records, market transactions)

- Time constraints and budget considerations

At Sun Business Valuations, our process begins with a thorough analysis of your specific situation to determine which approaches will yield the most accurate and defensible results. Often, we employ multiple methods to provide a comprehensive range of value indicators.

The Sun Business Valuation Difference: A Personalized Approach

Unlike many valuation firms that use templated “cookie-cutter” approaches, Sun Business Valuations customizes each engagement to your unique needs. Our clients consistently tell us that our personalized approach is what sets us apart from other business valuation companies.

We believe that a truly accurate business valuation requires more than just analyzing numbers—it requires understanding the story behind those numbers. That’s why we take the time to:

- Conduct in-depth interviews with key stakeholders

- Understand your company’s unique value drivers

- Assess industry-specific factors that impact valuation

- Consider your specific goals for the valuation

- Communicate complex concepts in straightforward language

This personalized approach ensures that your valuation is not only technically sound but also practically useful for your specific needs.

Our Credentials: Experience You Can Trust

Our professional business valuation services are backed by industry-recognized credentials:

- Professionals Certified by the National Association of Certified Valuation Analysts (NACVA) and have CVA credentials

- Professionals certified by the American Society of Appraisers (ASA)

- Professionals have achieved the CFA designation and CPA designations.

- Conform to IRS Revenue Ruling 59-60

Sun Business Valuations brings over 20 years of valuation experience in providing business valuation expertise and litigation support. Sun Business Valuations has been engaged by many premier professional firms in the country, including national, regional, and local law firms and their clients.

Our long-term affiliation with Sun Mergers & Acquisitions provides added credibility, unique insight into current market conditions, and up-to-date comparable industry transactions.

Our Valuation Process

Our well-defined process ensures that we consider all relevant approaches to identify the methodologies that best suit your company and valuation purpose:

- Preliminary Consultation: We discuss your objectives and the purpose of the valuation to ensure a complete understanding of your needs.

- Engagement Definition: After understanding your objectives, we provide a clear engagement summary outlining the scope, timeline, and fees.

- Comprehensive Data Gathering: Through detailed questionnaires, interviews, and financial document review, we develop a complete understanding of your business operations and financial position.

- In-depth Research and Analysis: We analyze company documents, recast financial statements, and research economic factors, industry trends, and comparable transactions.

- Methodology Selection and Application: Based on our analysis, we select and apply the most appropriate valuation approaches for your specific situation.

- Report Development: We create a comprehensive, defensible valuation report that thoroughly explains our methodology and conclusions.

- Management Review: We review the draft report with you and your advisors, making any necessary revisions before issuing the final document.

Industry-Specific Valuation Expertise

Different industries require different valuation considerations. Our experience spans numerous sectors, including:

Manufacturing & Distribution

- Inventory valuation methodologies

- Equipment and capital asset assessment

- Supply chain considerations

Healthcare

- Regulatory compliance impact

- Reimbursement risk assessment

- Practice versus entity valuation

Professional Services

- Human capital valuation

- Client relationship value

- Succession planning considerations

Technology & SaaS

- Recurring revenue modeling

- Customer acquisition cost analysis

- Churn rate impact assessment

Real Estate & Construction

- Property valuation integration

- Project backlog analysis

- Licensing and certification value

Common Valuation Challenges and Solutions

Challenge: Limited Financial History

Solution: For startups or young companies with limited historical data, we place greater emphasis on future projections, industry benchmarks, and asset-based approaches. We may also consider stage-of-development methods commonly used for early-stage companies.

Challenge: Inconsistent Financial Performance

Solution: When a company has shown irregular financial results, we carefully normalize earnings by adjusting for non-recurring items, owner perquisites, and unusual events to establish a reliable earnings base for valuation.

Challenge: Industry Disruption

Solution: In industries experiencing significant disruption, we incorporate scenario analysis and probability-weighted outcomes to account for various potential futures, ensuring that the valuation remains relevant despite market uncertainty.

Frequently Asked Questions

How long does a business valuation typically take?

The timeframe for completing a business valuation varies based on the complexity of the business, the purpose of the valuation, and the availability of information. At Sun Business Valuations, we’re committed to prompt turnaround times and typically provide a completed valuation within 10 to 15 business days of receiving all necessary information and having the client intake call..

How often should I have my business valued?

For most businesses, an annual or biennial valuation provides sufficient insights for planning purposes. However, you should consider a new valuation whenever significant events occur, such as major changes in your business model, substantial growth, industry disruption, or when preparing for a transaction.

Will different valuation approaches yield different results?

Yes, different approaches often produce varying value indications. This is expected and actually provides valuable insight into how different market participants might view your business. Our final conclusion reconciles these different indicators, giving appropriate weight to the most relevant approaches for your specific situation.

How can I increase my business’s value before a sale?

Key value drivers include strong and stable cash flows, a diversified customer base, established systems and processes that don’t rely on owner involvement, proprietary products or services, and strong growth potential. We can help identify specific areas for improvement in your business through a preliminary valuation.

Are business valuations just for businesses planning to sell?

No. While valuations are crucial for exits, they serve many other purposes, including tax planning, dispute resolution, financial reporting, strategic planning, and succession planning. Understanding your business’s value provides insights that can guide important business decisions regardless of sale intentions.

What makes Sun Business Valuations different from other valuation firms?

Unlike many firms that rely on templates and “boilerplate” formats, Sun customizes each valuation and the selection of valuation methodologies to address the unique purpose of the valuation and account for the individual aspects of each company and industry. Our clients consistently praise our comprehensive yet easy-to-understand reports and our hands-on, personalized approach.

Making Informed Decisions with Confidence

Selecting the right valuation approach is critical to obtaining an accurate assessment of your business’s worth. At Sun Business Valuations, we don’t apply a one-size-fits-all methodology. Instead, we carefully analyze your specific situation to determine which approach—or combination of approaches—will provide the most accurate and meaningful results.

Our experts bring years of experience across diverse industries and valuation scenarios, ensuring that your valuation is not only technically sound but also practical and relevant to your specific needs.

Get Your Professional Business Valuation Started Today

Ready to gain clarity on your business’s true value? Our team is ready to provide the personalized, expert business valuation services you need to make informed decisions.

Whether you need a valuation for a potential sale, a legal matter, or simply to plan your next strategic move, Sun Business Valuations is here to help. Call Stephen Goldberg, Managing Partner, at 800.232.0180, or complete this form to learn more about our process, time frame, and cost.

Sun Business Valuations provides professional business valuation services throughout the United States. Our certified experts deliver accurate, defensible valuations for businesses of all sizes across diverse industries.